The Chinese electric vehicle (EV) market, the world’s largest, is experiencing a slowdown and a fierce price war among domestic manufacturers.

Profits Plummet for EV Leaders

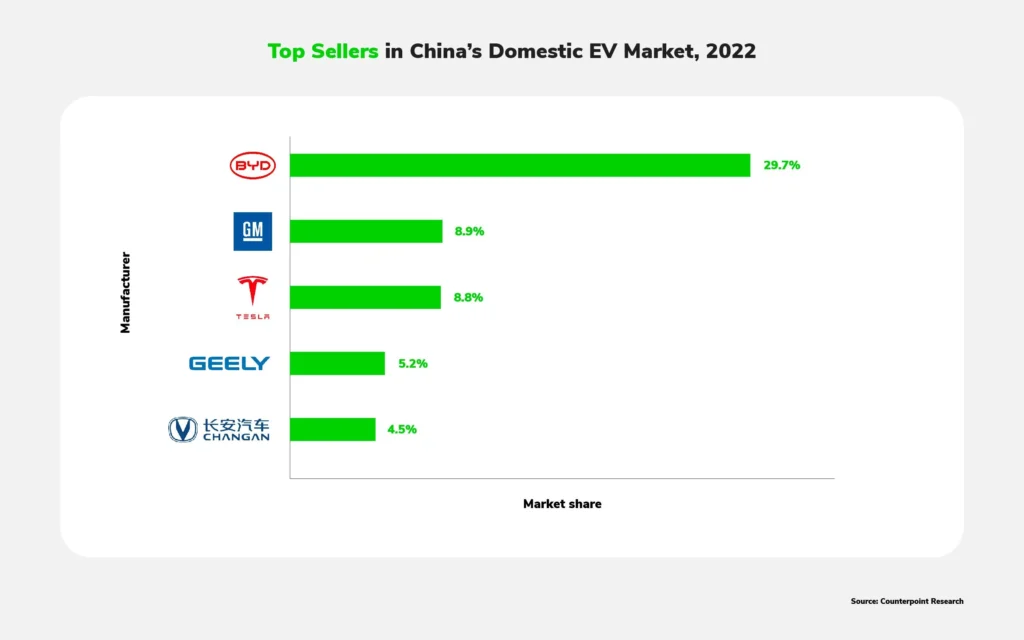

BYD, China’s top EV producer in 2023, reported a significant drop in Q1 2024 profits compared to the previous quarter. Their net profit fell by 47%, despite a 13.4% year-on-year sales increase. This slowdown is attributed to the Chinese New Year and increased competition.

Price Wars Erupt

BYD’s price cuts of 5-20% on plug-in models triggered a domino effect. Tesla responded by lowering prices on its China-made Model 3 and Y by over 5%, followed by similar reductions from Le Auto.

Profitability Threatened

Analysts at Goldman Sachs predict the price war could push the EV segment into negative profitability for 2024. The average EV price drop of 21,000 yuan ($2,900) has eroded profit margins, with average profit per EV falling from 2,100 yuan ($290) to negative 1,600 yuan ($220).

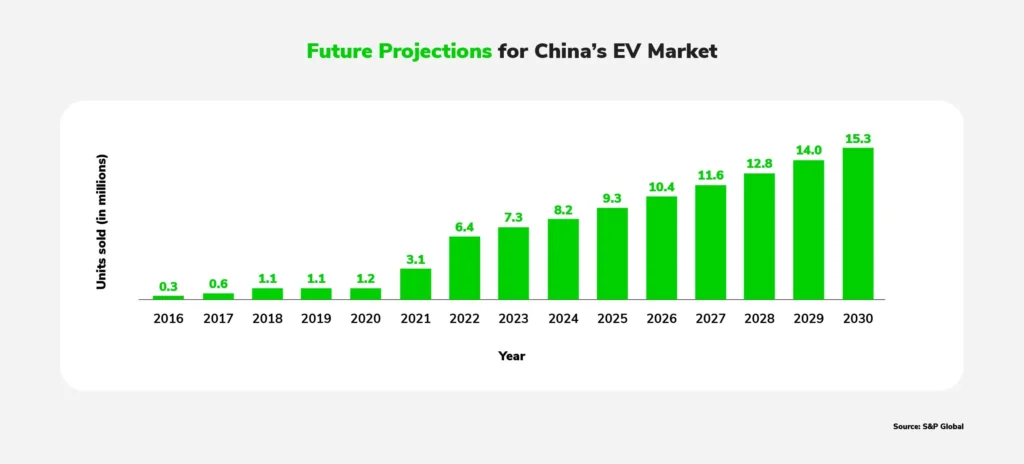

Future Outlook Uncertain

While the Chinese EV market remains the world’s largest, its growth rate has slowed. The intense competition and price war pose a challenge to the profitability of EV companies. Whether the market can recover and return to positive margins remains to be seen.

Also: Is the MG ZS EV toast? New Chinese challenger shocks market

1 thought on “Chinese EV Market Faces Challenges Despite Continued Growth”